Be the first to know! Get a head start on global political and economic events this week that shape your business, strategy, and programs in just 10 minutes. Subscribe to this newsletter to receive the latest edition, every Monday.

WEEK IN REVIEW

MONDAY

European Union’s Internal Market and Consumer Protection committee delegation will visit Ireland to assess the ongoing trade relationship between the EU and the UK after Brexit. The delegation aims to evaluate the implementation of the Protocol on Ireland and Northern Ireland and to get a better understanding of the effects this may have on the EU internal market and the Customs Union as well as on businesses and consumers (important to track for export functions of companies operating in UK and Europe). IMCO mission to Ireland, European Parliament. 16th Annual International Conference on Business and Society in a Global Economy, 19-22 December, Athens, Greece.

TUESDAY

Groundwater Governance in India: Role of Government & Industry: Rajasthan, Wed, Dec 21–22. China’s Environmental Blueprint – Opportunities for European Small and Medium Size Enterprises Workshop, EU SME Centre, Brussels.

WEDNESDAY

A slow day in politics as we approach Christmas.

THURSDAY

A slow day in politics as we approach Christmas.

FRIDAY

A slow day in politics as we approach Christmas.

SATURDAY & SUNDAY

A slow day in politics as we approach Christmas.

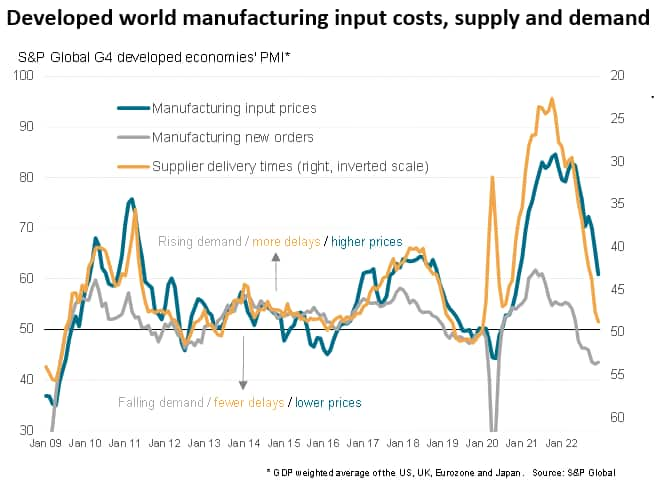

GLOBAL ECONOMIC PULSE

The social and political situation in Peru remains an important risk in Latin America. Inflation data out next week for the first half of December in Brazil and Mexico will be out this week. In Colombia labor unions and business associations reached an agreement on a 16% minimum wage increase for next year. A Latin America economic report provides a more granular picture. Major week for indicators in the U.S. as the following will be released: Housing starts (Tuesday), Existing home sales (Wednesday), Consumer confidence (Wednesday), Q3 GDP (Thursday), Jobless claims (Thursday), Spending and incomes (Friday), New home sales (Friday), Durable goods orders (Friday). UK releases revised Q3 GDP. Eurozone consumer confidence numbers will be released. The impact of lower inflation and fiscal help with the region’s energy is to be seen. China‘s Loan Prime Rate will also be updated as will key inflation figures in Japan and Singapore.

Quarterly earnings announcements this week: Steelcase, Softbank Group, Fed Ex, Nike, General Mills, BHP, ElectroBras, Neogen, Micron, Olympus, Unicharm.

Last Week’s Noteworthy REPORTS, REGULATIONS, LEGISLATION, DECISIONS & EVENTS

The outlook for global steel markets has deteriorated sharply. Factors contributing to weaker prospects include the global economic slowdown, high energy prices, accelerating inflation, and geopolitical instability. Read the details in this OECD report. [Important for companies that use steel in production of final products like auto manufacturers].

For the first time, a range of oil demand scenarios — including those created by industry, international organizations, and research institutes — project that, if the current pace of climate policy action continues, global demand for oil will peak before 2030 and decline steadily afterwards. Read the details in Canada’s Pembina Institute report.

An analysis of Tesla’s Innovation Strategy has been published.

The Recovery and Resilience Facility (RRF) is the main element of the EU’s innovative financing instrument, Next Generation EU (NGEU), established with the aim to drive the EU’s post-pandemic economic recovery towards a resilient future. The digital strategy of this plan has been published.

World Health Organization presented a resolution on Infection Prevention & Control (IPC) and was and by consensus at the Seventy-fifth World Health Assembly. The resolution included 13 calls to Member States for improving IPC at the national, subnational and facility levels, in line with the World Health Organization (WHO)-recommended core components for IPC programs. It also requested the Director-General to develop a global strategy on IPC (GSIPC), a global action plan, and a monitoring framework in consultation with Member States and regional economic integration organizations. The WHO Global IPC Draft Action Plan was published last week.

Australia published its biannual Australia National Health Plan.

How can we help you?

We offer three premiere services you can use. We conduct government and market research on important market segments of interest to you. If you need to engage with members of the executive branch, legislative branch, and influential stakeholders we can help you develop an advocacy strategy and design it to yield the right type of engagement with influencers and decisionmakers. Finally, in many of these engagements, you will have to present your proposal or ask by demonstrating its public value. We can do the public value analytics using our worldwide databases and modeling tools for you and seamlessly imbed them in your proposals. We have experience precisely doing these types of projects in the U.S., Central and South America, European Union, Middle East, China, India, Japan, Korea, Southeast Asia.

Slug: geopolitical-week-ahead-2022-11-21