Be the first to know! Get a head start on global political and economic events this week that shape your business, strategy, and programs in just 10 minutes. Subscribe to this newsletter to receive the latest edition, every Monday.

#publicpolicy #businessintelligence #marketaccess #events #governmentanalytica

WEEK IN REVIEW

MONDAY

The first meeting of the United Nations Intergovernmental Negotiating Committee (INC) to develop an international legally binding instrument on plastic pollution, including in the marine environment (Plastic Pollution INC-1), Punta del Este, Maldonado, Uruguay. European Commission Special Committee on the COVID-19 pandemic: lessons learned and recommendations for the future meets in Brussels. The 17th annual Internet Governance Forum (IGF) will be hosted by the Government of Ethiopia, Addis Ababa.

TUESDAY

EU will vote on establishing “Union Secure Connectivity Program for the period 2023-2027” provisional agreement, Brussels. EU will discuss methane emissions reduction in the energy sector and amending Regulation (EU) 2019/942 continuing into Wednesday. The UN World Meteorological Organization (WMO) will launch State of Global Water Resources report. The Conference Board publishes its November consumer-confidence index measures U.S. population outlook toward job market and overall economy. Consumer confidence fell in October.

WEDNESDAY

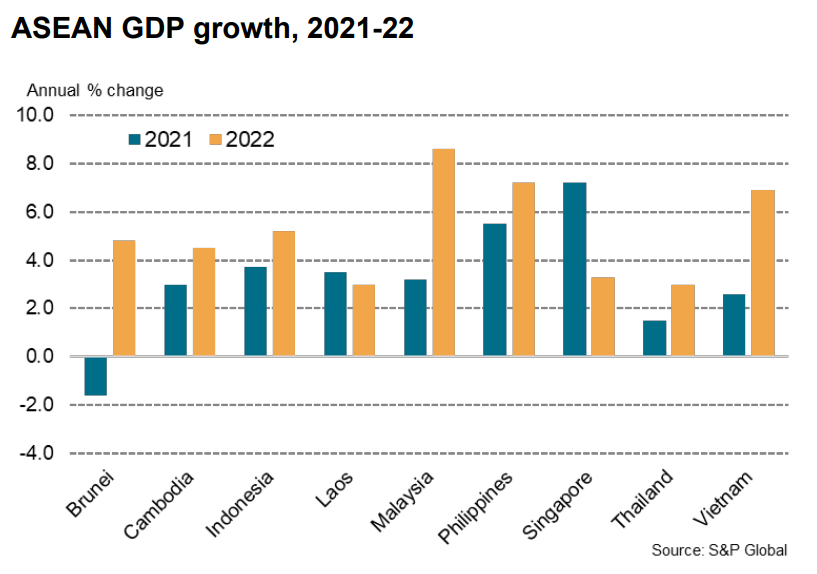

Thailand Building Fair 2022 starts in Bangkok, Thailand. EU commission will discuss “Safe and Efficient Development of a Drone Ecosystem” in the EU (program). EU Comm on International Trade will be getting ready for next meeting of the EU-US Trade and Technology Council, trade-related aspects of EU’s partnerships with third countries on raw materials the EU trade objectives ahead of the EU-ASEAN Summit on 14 December 2022. The International Labor Organization (ILO) is expected to release its Global Wage Report for 2022/2023.

THURSDAY

Environment Impact Assessments for Infrastructure Masterclass, London, United Kingdom. EU Competitiveness Council will discuss the EU Chips Act presented on 8 February 2022. The package aims to reduce the EU’s vulnerabilities and dependencies and improve the EU’s security of supply, resilience and technological sovereignty in the field of semiconductor applications and technologies. The ministers will also aim to reach a general approach on the directive on corporate sustainability due diligence (CSDD) imposing a legal obligation on companies to identify and prevent, end or mitigate the impact of their activities especially on the environment in addition to other areas.

FRIDAY

EU will hold Conference on the Future of Europe session in Brussels, Paul-Henri Spaak, Plenary Chamber. The three Presidents of the EU institutions will open the event. The World Health Organization (WHO) is expected to launch its Global Report on Health Equity for Persons with Disabilities. To join the webinar launch of the report, click here.

SATURDAY & SUNDAY

A quiet weekend in politics.

GLOBAL ECONOMIC PULSE

Worldwide manufacturing PMI for November will be released. Manufacturing in US, UK, eurozone and Japan dropped more rapidly compared to services activity. Prices are easing with supply delays improving. US third quarter GDP, consumer confidence and labor market employment reports will be released. In Europe inflation, business climate, Germany employment data will be released. Europe inflation data is set to be released on Wednesday. China NBS PMI data, Bank of Thailand meeting, South Korea, Taiwan GDP, Indonesia inflation will all reported this week. The Fed releases its periodic compilation of economic information gathered from U.S. businesses (Beige Book). Transport bottlenecks are easing for both supply and demand evidenced by the ports of Los Angeles and Long Beach in California, handling about 40% of U.S imported goods, report congestion has eased. UK Inflation hit a 41-year high in October, up 11.1% from a year earlier. European Central Bank (ECB) continues to tighten monetary policy concerned that higher borrowing costs and high inflation will create substantial risk in the Eurozone. Blackrock reports that the share of the U.S. population in work or seeking a job is still below pre-Covid levels. This shortfall won’t be made up: A bigger share of people are older than the normal retirement age – a major constraint. That makes it hard for the economy to operate at current activity levels without fueling inflation.

Earnings will be reported this week by HP Enterprise, Intuit, Crowd Strike, Donaldson, Hormel Foods, Salesforce, Krogers, Dollar General, and Ulta.

NOTEWORTHY REPORTS, REGULATIONS, LEGISLATION, DECISIONS & EVENTS

- Glasgow Financial Alliance for Net Zero (“GFANZ”) published a report to support financial institutions’ efforts to develop and implement net-zero transition plans.

- Latin America Energy Transition Readiness report was published by Siemens Energy.

- Latin America foreign direct investment was at $134 billion in 2021, an 8% allocation of global FDI, and grew by 52% YOY, marching ahead of Africa and economies in transition (CEE, Baltics, CIS, and parts of Asia) according to report.

- Wilson Center convened an event with Latin America Agriculture Ministers.

- Ministries of Finance as center-of-government bodies are at the center of coordinating economic, fiscal and financial policymaking and can play a key role in driving climate action. A new report by Coalition of Finance Ministers for Climate Action describes how. Incentives are one of the levers of climate policy and businesses should track developments for opportunities.

- Tony Blair Institute for Global Change published a report on fixing Brexit.

- European Parliament published a study on Tackling Global Inflation at a Time of Radical Uncertainty.

- UK Office of Budget responsibility, after seven forecast rounds under three Prime Ministers and three Chancellors, working towards three official forecast dates published its report, “UK Economic and Fiscal Outlook – November 2022” reflecting policies announced in five major fiscal statements since March.

- Energy prices play a crucial role in influencing geopolitical risks, especially for the major suppliers of energy resources. A paper has been published analyzing these factors for the European Union.

- Report titled “How COVID-19 is shaping the landscape for long-term investors” has just been published.

- PWC has published a report about Asia Pacific region and the five aligned and mutually reinforcing success factors that will drive differentiation and competitiveness for business and governments to prosper in the region.

- On November 9th, in the naval port of Toulon, President Macron unveiled France’s new assessment of its risks in the National Strategic Review 2022 with a 10 point plan.

- State of US Semiconductor industry was published by the US Semiconductor Association.

- World Medical Association, a group of national medical associations of various countries have published their handbook.

How can we help you?

We offer three premiere services you can use. We conduct government and market research on important market segments of interest to you. If you need to engage with members of the executive branch, legislative branch, and influential stakeholders we can help you develop an advocacy strategy and design it to yield the right type of engagement with influencers and decisionmakers. Finally, in many of these engagements, you will have to present your proposal or ask by demonstrating its public value. We can do the public value analytics using our worldwide databases and modeling tools for you and seamlessly imbed them in your proposals. We have experience precisely doing these types of projects in the U.S., Central and South America, European Union, Middle East, China, India, Japan, Korea, Southeast Asia.

Contact us so we can learn about your needs, and you can learn about our capabilities.

geopolitical-week-ahead-2022-11-28