Be the first to know! Get a head start on global political and economic events this week that shape your business, strategy, and programs in just 10 minutes. Subscribe to this newsletter to receive the latest edition, every Monday.

WEEK IN REVIEW

MONDAY

Biden is scheduled to meet with Mexican President Andrés Manuel López Obrador and Canadian Prime Minister Justin Trudeau during the North American Leaders’ Summit in Mexico City on Jan. 9 and 10.

The UN-backed Scientific Assessment Panel to the Montreal Protocol on Ozone Depleting Substances quadrennial assessment report, published every four years, will be released.

TUESDAY

A quiet day in politics.

WEDNESDAY

A quiet day in politics.

THURSDAY

Plenary Session of the European Parliament is held in Strasbourg, France. European Union’s Committee on the Environment, Public Health and Food Safety meets in Brussels. The following major legislative and regulatory packages are under review:

– Regulation concerning batteries and waste batteries, repealing Directive 2006/66/EC and amending Regulation (EU) No 2019/1020

– Establishing a carbon border adjustment mechanism

– Amending Directive 2003/87/EC as regards aviation‘s contribution to the Union’s economy-wide emission reduction target and appropriately implementing a global market-based measure

– Amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union, Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and Regulation (EU) 2015/757

– Establishing a Social Climate Fund

– Amending Decision (EU) 2015/1814 as regards the amount of allowances to be placed in the market stability reserve for the Union greenhouse gas emission trading scheme until 2030

– Amending Regulation (EU) 2021/241 as regards REPowerEU chapters in recovery and resilience plans and amending Regulation (EU) 2021/1060, Regulation (EU) 2021/2115, Directive 2003/87/EC and Decision (EU) 2015/1814

– Amending Directive (EU) 2018/2001 on the promotion of the use of energy from renewable sources, Directive 2010/31/EU on the energy performance of buildings and Directive 2012/27/EU on energy efficiency

– Establishing a framework for setting ecodesign requirements for sustainable products and repealing Directive 2009/125/EC

UN DESA. They will brief journalists on the World Social Report 2023. This UN flagship report urges countries to take steps to reap the socio-economic benefits of an ageing world while addressing challenges.

FRIDAY

A quiet day in politics.

SATURDAY & SUNDAY

A quiet weekend in politics.

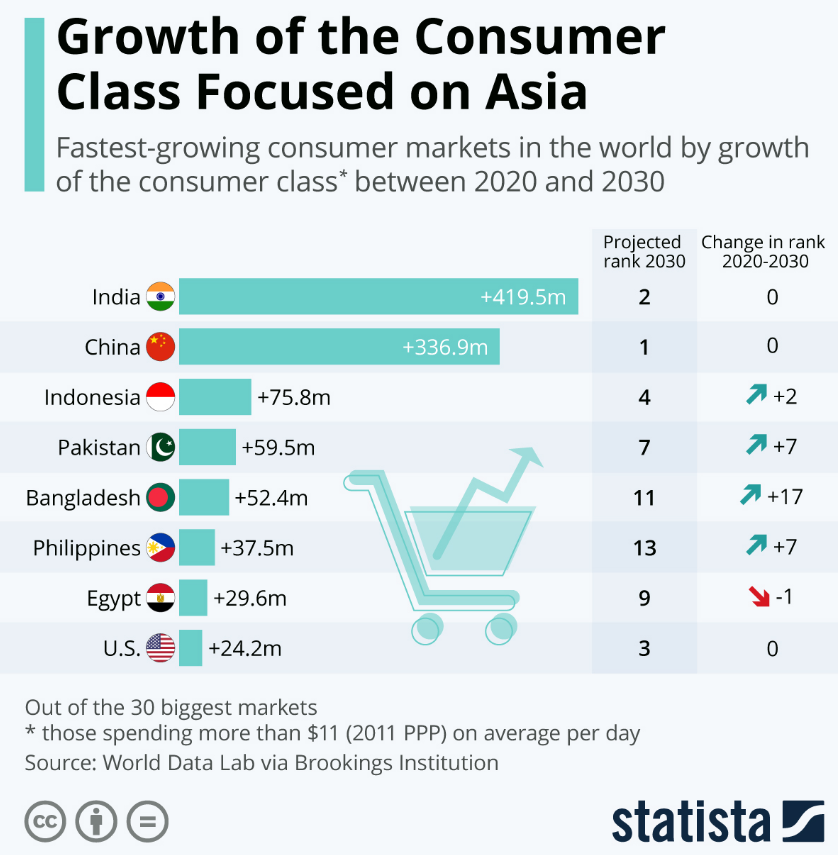

GLOBAL ECONOMIC PULSE

US and China Consumer Price Index data and China’s trade numbers will be released this week. UK publishes its monthly GDP figures for November. Eurozone’s unemployment and industrial production statistics will be out. Bank of Korea is expected to raise rates this week while attention will also be on comments from Fed speakers for insights into US policy. US corporate earnings releases are forthcoming in the next couple of weeks. China business confidence about the year ahead is at its highest since May 2021. That said, the China PMI’s overall current business activity index remained in contraction territory amid the flaring up of COVID-19 cases. A return to expansion is expected. The US Central Bank, the Federal Reserve, continued to view inflation as concerning despite the recent easing of inflationary pressures. Asia Pacific economies are facing both tightening financial conditions and a deteriorating global economic outlook.

The U.S. economy will struggle in 2023 with halting growth and higher unemployment. Recession is a serious threat. But the Moody’s Analytics baseline forecast—the most-likely outlook—holds that the economy will avoid a downturn in their report: The Slowcession. EY published its 2023 Global Macroeconomic Outlook.

Earnings is reported this week by: Alberstson’s, Yaskawa Electric, Industria de Diseno Textil, Infosys, Wipro Ltd, Shaw Communications, Taiwan Semiconductor, United Health Group, JP Morgan, Bank of America, Wells Fargo, Black Rock, Citi Group, Delta.

NOTEWORTHY REPORTS, REGULATIONS, LEGISLATION, DECISIONS & EVENTS

Political watch in Latin America:

- Argentina: Argentines are set to elect a new president, Congress and governors in most provinces on Oct. 29.

- Brazil: Country’s new leadership has big ambitions for regional integration and global leadership, in addition to a domestic agenda.

- Chile: The first attempt at ushering in a radically new constitution last year failed, a second attempt is coming.

- El Salvador: Battle against organized crime still in force under a national state of emergency.

- Mexico: Government is in a firm push for elections reform.

- Peru: Political unrest may continue.

- Venezuela: U.S. has already softened its approach and this year will test just how much relations can shift.

U.S. Science and Technology Issues for US Congress was published by Congressional Research Service.

Gibson Dunn published and assessment of the United Nations (“UN”) Biodiversity Conference in Montreal, Canada, agreement.

Netherlands Institute of International Relations ‘Clingendael’ published Strategic tech cooperation can reinvigorate relations between the EU and India

Hogan Lovells published a compendium of resources for health care companies around COVID-19

World Economic Forum published a report on How Payment Models can Transform Healthcare Systems.

The U.S. Centers for Disease Control and Prevention (CDC) has modified its structure by the establishment of the Center for Forecasting and Outbreak Analytics.

Title 28 of the US Public Health Service Act as been amended with new framework for public health emergencies: TITLE XXVIII—NATIONAL ALL-HAZARDS PREPAREDNESS FOR PUBLIC HEALTH EMERGENCIES

Adaptation should be seen as essential to tackling the climate impacts that cannot now be avoided – yet it’s too often ignored by investors, leaving the world at risk of ever-greater climate-related losses. JP Morgan suggests investing in adaptive solutions is an opportunity in Adapting to a Warmer Planet in portfolio investing.

The Directory of European Commission members and staff has been published.

How can we help you?

We offer three premiere services you can use.

- We conduct government and market research on important market segments of interest to you.

- If you need to engage with members of the executive branch, legislative branch, and influential stakeholders we can help you develop an advocacy strategy and design it to yield the right type of engagement with influencers and decisionmakers.

- Finally, in many of these engagements, you will have to present your proposal or ask by demonstrating its public value. We can do the public value analytics using our worldwide databases and modeling tools for you and seamlessly imbed them in your proposals.

We have experience precisely doing these types of projects in the U.S., Central and South America, European Union, Middle East, China, India, Japan, Korea, Southeast Asia.

geopolitical-week-ahead-2023-01-09