THIS WEEK

- UN Water conference,

- US 2024 Federal Budget Hearings

- Silicon Valley Bank failure

Be the first to know! Start your week with a generous dose of foresight. In just 5 minutes get a head start on global political and economic events this week that will shape your business, strategy, and portfolio. Be the first to lead! Subscribe to our newsletter to receive the latest edition, every Monday.

#governmentanalytica #electricvehicles #batteries #pandemics #artificialintelligence #safety #singleuseplastic #globalhealth #asean #apec #eu #latinamerica #chinabusiness #techindustry #lifescienceindustry #medicaldevices #pharmaindustry

GOVERNMENT ANALYTICA ACADEMY: Learn more about 6-steps to Effective Government Advocacy with this quick 1-pager. Contact us to learn more about our capabilities and see how we can be of service to you.

HAPPENING THIS WEEK

MONDAY

- U.S. 2024 National Budget hearing gets underway this week in US Congress.

- The 37th International Conference on Solid Waste Technology and Management, 19-23 March, Washington, DC

- CSAE Conference 2023: Economic Development in Africa, 19-21 March, Oxford, United Kingdom

- International Conference on Environmental Safety and Health, 20-21 March, Prague, Czech Republic

- 5th World Summit on Renewable Energy and Resources, 20-21 March, Berlin, Germany

TUESDAY

- Events of previous days continue.

WEDNESDAY

- UN Water Conference running through Friday will focus on the linkages between water, health, sustainable development, climate resilience, and environmental cooperation. It is the first meeting on the water security specifically since 1977. At 9:30 a.m., in the General Assembly Hall, there will be the opening of the UN 2023 Water Conference. Organized by the UN Department of Economic and Social Affairs (DESA) as the Secretariat and supported by UN-Water, the conference will continue until 24 March. At 3 p.m., there will be a hybrid briefing entitled Turning the tide: A Call to Collective Action by the Global Commission on the Economics of Water. Speakers will be: Mariana Mazzucato, Professor at University College London & Founding Director of the UCL Institute for Innovation and Public Purpose ; Ngozi Okonjo-Iweala, Director-General, World Trade Organization ; Johan Rockstrom, Director, Potsdam Institute for Climate Impact Research (PIK) ; Tharman Shanmugaratnam, Senior Minister and Coordinating Minister for Social Policies, Government of Singapore. Website of the UN 2023 Water Conference Program of the UN 2023 Water Conference Documents of the UN 2023 Water Conference

- Today is the launch of Asia and the Pacific SDG Progress Report 2023.

- U.S. Senate Committee on Health, Education, Labor, and Pensions, Hearings to examine Moderna considering quadrupling the price of the COVID vaccine (Meeting Details).

- U.S. Senate Committee on Homeland Security and Governmental Affairs, Hearings to examine drug shortage health and national security risks, focusing on underlying causes and needed reforms (Meeting Details).

- U.S. Senate Committee on the Budget, Hearings to examine how climate change is changing insurance markets (Meeting Details).

THURSDAY

- Events of previous days continue.

FRIDAY, Saturday & Sunday

Slow days in politics.

GLOBAL ECONOMIC PULSE

Federal Reserve, Bank of England, and other national banks are slated to keep raising rates. China 1-year and 5-year loan prime rates are 3.65% and 4.30%, respectively. Interest rate decisions are expected from Brazil (currently at 13.75%), Nigeria (currently at 17.5%) and Turkey (currently at 8.5%). Malaysia, Mexico and South Africa will release their Consumer Price Index. Brazil’s government appears likely to present a new fiscal rule to replace the constitutional spending cap that President Lula has promised to abolish. Central Banks and national financial authorities are caught between their inflation fight and further financial stability restoration duties in light of the collapse of Silicon Valley Bank.

Earnings Reports This Week: PDD Holdings Inc. (PDD), Aegon (AEG), and Foot Locker Inc. (FL), Nike (NKE), Tencent Music Entertainment Group (TME), Gamestop Corp. (GME), HealthEquity Inc. (HQY), and Manchester United Ltd. (MANU), Woodside Energy Group Ltd. (WDS), Chewy Inc. (CHWY), and H.B. Fuller Company (FUL), Accenture (ACN), General Mills (GIS), Darden Restaurants (DRI), and FactSet Research Systems (FDS)

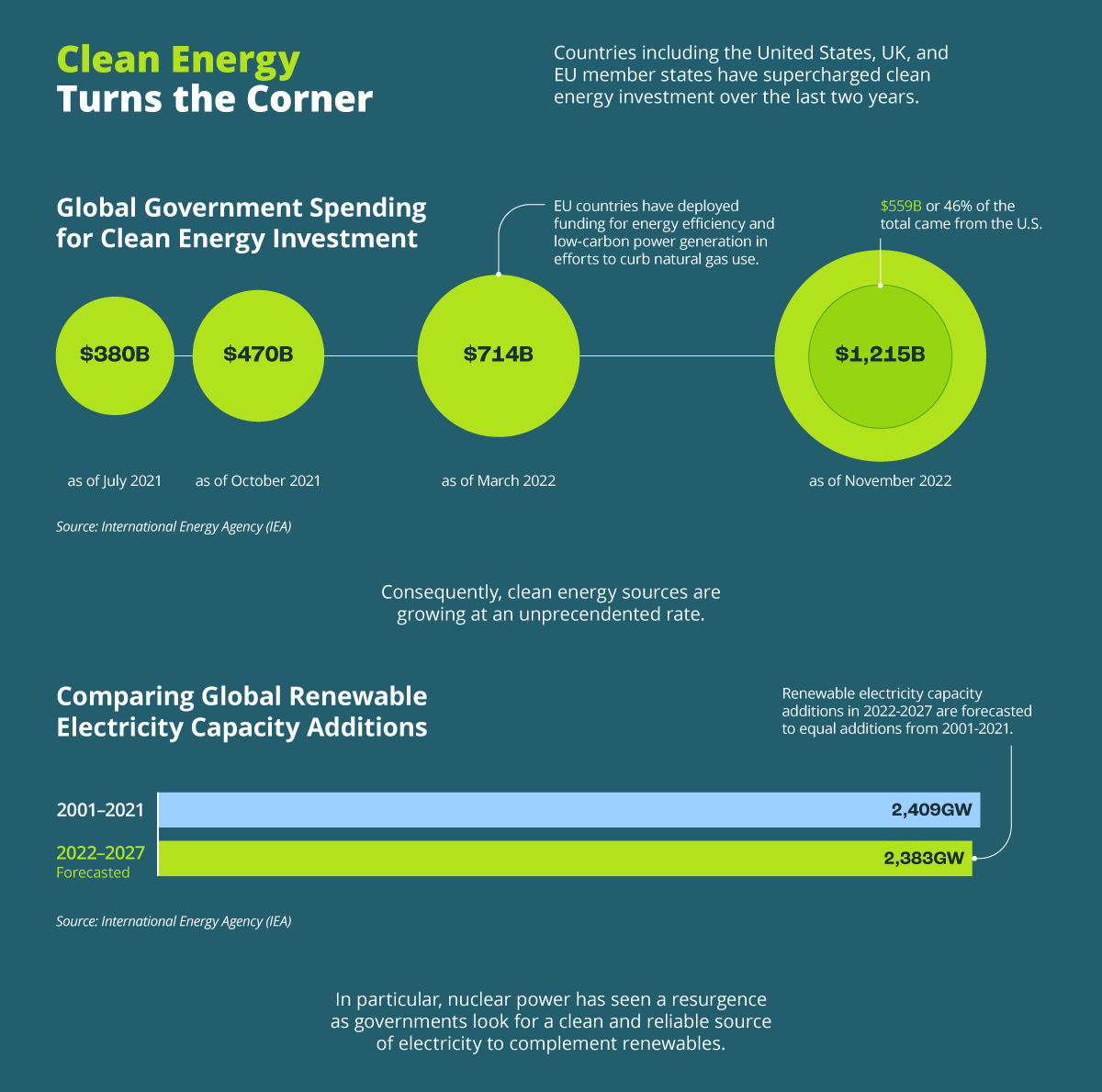

Source: Visual Capitalist

NOTEWORTHY REGULATIONS, LEGISLATION, DECISIONS & REPORTS

China’s new cabinet sets bold priorities for year ahead. The highlights of the developments can be found in Canada’s Asia Pacific Foundation summary.

Latest update to the Official Directory of Personnel in the European Union has been published.

The Conference Board has published an assessment of the Silicon Valley Bank failure.

United Nations published its annual Innovation and Technology Report.

Deloitte published a report on global life sciences companies abandoning trusted tactics and trying new approaches to respond to hidden risks within supply chains.

European Parliamentary Research Service published Securing Europe’s supply of critical raw materials.

U.S. published its National Aeronautics Science and Technology Policy.

U.S. President delivered the required U.S. Annual Economic Report to Congress.

U.S. Congressional Research Service published a compendium of Digital Trade & Data Policy Issues.

How can we help you? Click to learn …

Contact us to learn more about our capabilities and see how we can be of service to you.

AREAS WE TRACK

POLITICAL LEADERSHIP: Covering changes in political leadership and elections.

GEOPOLITICS & POLITICAL RISK: Movements of government positions in multilateral organizations. Major changes in governments policies and regulations.

SUPPLY CHAINS & INDUSTRIAL POLICY: Major global issues around trade, trade relations and supply chains.

ECONOMY: Major countries’ economic developments, major changes in GDP and other economic indicators. Investments, jobs, monetary pressures in key economies.

FISCAL STIMULUS or SURPLUS SPENDING: Government investments in economic stimulus and social assistance. Government social assistance to businesses. External or internal national investments.

TAXES: Changes in taxation regulation for VAT, corporate tax, other forms of taxation.

LABOR: Employment and unemployment trends and regulations. Workforce changes and shifts in labor demands.

FINANCIAL SERVICES: Multilateral financial institution investments in new projects. National banks and important monetary decisions.

INFRASTRUCTURE & CONSTRUCTION: Major new infrastructure investment projects focused on transportation (roads, rail, aviation, shipping), municipal water systems, national and regional electrical grid, telecommunication & broadband.

ENERGY & ENVIRONMENT: Government investments and regulation in support of major environmental policies. Investment and regulation for energy production including oil & gas and renewables, smart electricity transmission and distribution. Investment and regulation for point-of-use electrification.

HEALTHCARE: Major new health policies and regulatory changes in key economies around the world. Major global new or updated pharma or medical device regulations. New emerging threats of infectious diseases and outbreaks. Pandemic preparedness and response.

TECHNOLOGY: Major movements in government technology policy. Major technological advancements impacting market verticals.

AVIATION: Airlines and aviation company developments including MRO. Flag carrier policy developments.

AUTO INDUSTRY: Major auto industry trends and government policy.

READERSHIP PROFILE

Our subscribers are C-Suite executives, leaders in associations, nonprofits, NGOs, major consulting companies, think tanks, ministers, and members of parliaments. They hail from the U.S. and other developed and fast-growing emerging economies. On average, over 70% open and read our newsletter. Start your week with a generous dose of foresight.