THIS WEEK

– International Conference on Chemical Management

– UN 2023 Water Conference

– European Parliament

– Global Phase Out of Gasoline Cars

– Germany’s New ESG Law

Be the first to know! Start your week with a generous dose of foresight. In just 5 minutes get a head start on global political and economic events this week that will shape your business, strategy, and portfolio. Be the first to lead! Subscribe to our newsletter to receive the latest edition, every Monday.

#governmentanalytica #electricvehicles #batteries #pandemics #artificialintelligence #safety #singleuseplastic #globalhealth #asean #apec #eu #latinamerica #chinabusiness #techindustry #lifescienceindustry #medicaldevices #pharmaindustry

GOVERNMENT ANALYTICA ACADEMY: Learn more about 6-steps to Effective Government Advocacy with this quick 1-pager. Contact us to learn more about our capabilities and see how we can be of service to you.

HAPPENING THIS WEEK

MONDAY

An intense schedule of 2024 Budget Hearings continue in U.S. House of Representatives and Senate.

TUESDAY

Gas and hydrogen package – Ministers will seek a general approach on the gas and hydrogen package, which includes a proposal for a directive and a proposal for a regulation on common internal market rules for renewable and natural gases and hydrogen. The proposals seek to facilitate the penetration of renewable and low-carbon gases into the energy system, enabling a shift away from natural gas and to allow for these new gases to play their role towards the goal of EU climate neutrality in 2050.

Gas demand reduction – EU energy ministers will seek a political agreement on a proposal to extend a Council regulation on a voluntary reduction of natural gas demand by 15% ahead of winter. Under the proposal, the voluntary 15% gas demand reduction target would be maintained until March 2024.

Electricity market design – Ministers will hold a first policy debate on a proposal to revise the EU electricity market design. The proposal aims to make the EU energy market more resilient and stable, to shield consumers and companies from short-term electricity price volatility, and to drive investments into renewable energies.

EU Parliament’s negotiating position for an ambitious reduction of fluorinated greenhouse gases emissions, to further contribute to the EU’s climate neutrality goal, and for additional cuts of the emissions of substances that damage the ozone layer, in line with the European Green Deal and international agreements, will be debated on Wednesday and put to a vote on Thursday.

United Nations Asia-Pacific Forum on Sustainable Development 2023 – 27-30 March 2023 | Bangkok (Krung Thep), Thailand

The 5th Annual Workplace Health and Safety, Sydney Australia

Americas National Government Business Development Meeting, Miami

33rd International Conference on Ecological Agriculture, Biodiversity, Water & Waste Management, 27-29 March 2023, Istanbul, Turkey

International Conference on Climate Change Technology, 27-28 March 2023, Singapore

WEDNESDAY

Managing the growing burden of respiratory infections in the EU, Politico Events presented by Cepheid, Speakers: Dr Andrea Ammon, Oliver Bisazza, MEP Sara Cerdas, Prof. Dr Ray Walley, Professor Albert Osterhaus 11:00 AM CEST

8th Latin American Forestry Congress, 27-30 March 2023 | Mendoza, Argentina

THURSDAY

Many previous days’ events run through Thursday.

FRIDAY

ASEAN Finance Ministers and Central Bank Governors’ Meeting, Bali (Indonesia)

SATURDAY & SUNDAY

On Sunday elections in Finland (Finnish Parliament), Bulgaria (Bulgarian National Assembly), Montenegro (Presidency of Montenegro)

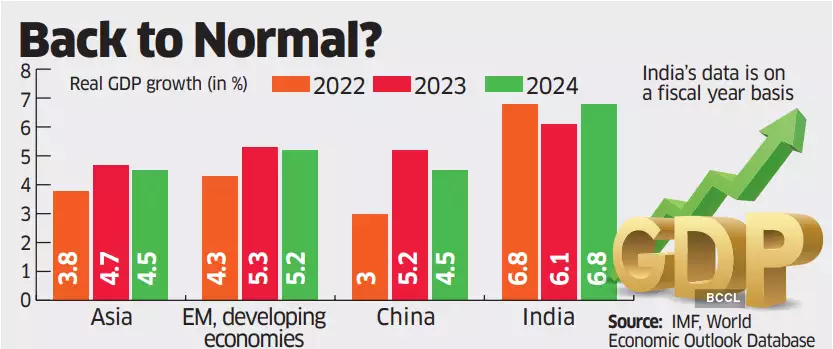

GLOBAL ECONOMIC PULSE

U.S. personal consumer expenditures and Eurozone and Japan inflation will be released. Purchasing Managers’ Index (PMI) from China and Industrial Production from Thailand and Mexico will be reported. Monetary policy will be underway in Thailand, South Africa, Colombia, and Mexico. Assessments are shifting toward “end of tightening cycles” forward outlook. The IMF approves a 4-year $3bn program for Sri Lanka and Argentina develops tactics to manage her macroeconomic situation. S&P Global reports “developed world growth is being driven almost entirely by the services economy, which is surprising given the sector’s exposure to higher interest rates and the impact of the cost-of-living squeeze on households.” It remains skeptical of the resilience of the upturn, it is in part a results of short-term factors such as a warmer than usual start to the year and a post-pandemic tailwind for travel.

Earnings Reports This Week: BioNTech (BNTX), H World Group Ltd. (HTHT), Carnival Corporation (CCL), PVH Corp. (PVH), and Reata Pharmaceuticals (RETA), Micron Technology Inc. (MU), Lululemon Athletica (LULU), Walgreens Boots Alliance (WBA), McCormick & Company (MKC), and Jefferies Financial Group (JEF), Cintas Corporation (CTAS), Paychex Inc. (PAYX), Concentrix Corp. (CNXC), RH (RH), Unifirst Corporation (UNF), and Lithium Americas Corp. (LAC), Yamana Gold Inc. (AUY), National Beverage Corp. (FIZZ), Neogen Corporation (NEOG), Braze Inc. (BRZE), Rumble Inc. (RUM), and BlackBerry Ltd. (BB)

NOTEWORTHY REGULATIONS, LEGISLATION, DECISIONS & REPORTS

- U.S. Agency for International Development has published its USAID Policy Framework. It establishes three overarching priorities for its programs: first, to confront the greatest challenges of our time; second, to embrace new partnerships; and third, to invest in USAID’s effectiveness.

- Ernst & Young published a report on Three CEO insights on the economy, digital and geopolitics

- European Commission published Investment needs-assessment and funding-availabilities to strengthen EU’s Net-Zero technology manufacturing capacity

- German Law Journal published The Covid 19 Exogenous Shock and the Crafting of New Multilateral Trade Rules on Subsidies and State Enterprises in the Post-Pandemic World

- Deloitte published Boosting resilience: Working with like-minded partners to orchestrate critical supply chains

- Morgan Stanley published Untangling Supply Chain Linkages

- PWC India published Paradigm Shift in Supply Chain Management

- Boston Consulting published Building The Green Hydrogen Economy

- European Parliament published Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on substantiation and communication of explicit environmental claims (Green Claims )Directive

- The White House published A Federal Framework and Action Plan for Climate Services

- The White House published BOLD GOALS FOR U.S. BIOTECHNOLOGY AND BIOMANUFACTURING HARNESSING RESEARCH AND DEVELOPMENT TO FURTHER SOCIETAL GOALS

- UK government published its UK International Technology Strategy

- U.S. Congressional Research Service published International Trade and Finance: Overview and Issues for the 118th Congress

How can we help you? Click to learn …

Contact us to learn more about our capabilities and see how we can be of service to you.

AREAS WE TRACK

- MULTILATERAL INSTITUTIONS & DEVELOPMENT

- GEOPOLITICS & POLITICAL RISK

- SUPPLY CHAINS & INDUSTRIAL POLICY

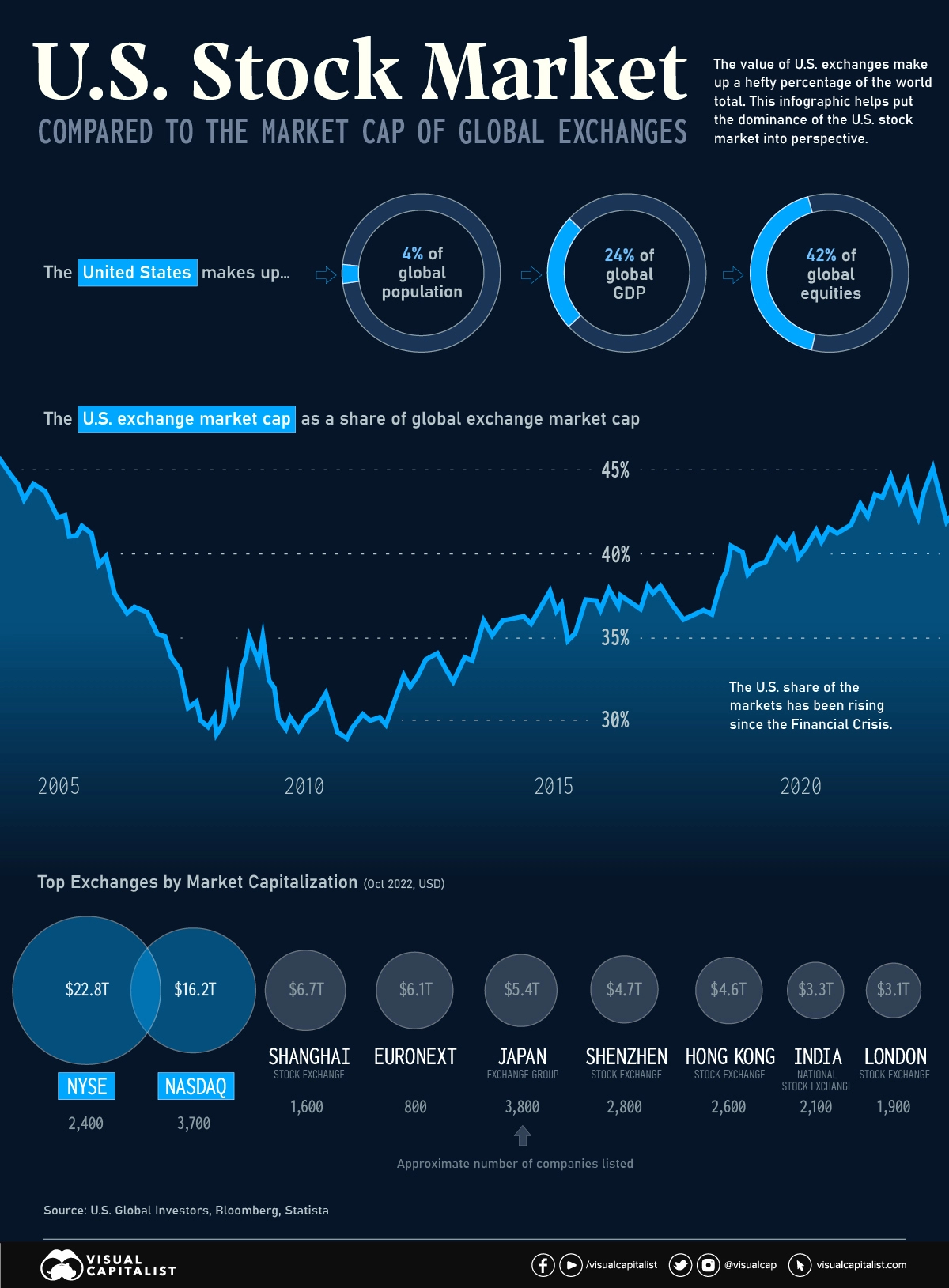

- ECONOMY, FISCAL STIMULUS & SURPLUS SPENDING

- FINANCIAL SERVICES, LABOR & TAXES

- INFRASTRUCTURE & CONSTRUCTION

- ENERGY & ENVIRONMENT

- HEALTHCARE

- TECHNOLOGY

- AEROSPACE & AVIATION

- AUTO & ELECTRIC VEHICLE INDUSTRY

READERSHIP PROFILE

Get a head start on upcoming global political and economic events this week that will shape your business, strategy, and portfolio in just 5 minutes. Our subscribers are: C-Suite executives, leaders in associations, nonprofits, NGOs, major consulting companies, think tanks, ministers and members of parliaments. They hail from the U.S. and dozens of other countries, mostly developed and fast-growing emerging economies. On average, over 70% open and read our newsletter. Start your week with a generous dose of foresight.