THIS WEEK

– International Conference on Chemical Management

– UN 2023 Water Conference

– European Parliament

– Global Phase Out of Gasoline Cars

– Germany’s New ESG Law

Be the first to know! Start your week with a generous dose of foresight. In just 5 minutes get a head start on global political and economic events this week that will shape your business, strategy, and portfolio. Be the first to lead! Subscribe to our newsletter to receive the latest edition, every Monday.

#governmentanalytica #electricvehicles #batteries #pandemics #artificialintelligence #safety #singleuseplastic #globalhealth #asean #apec #eu #latinamerica #chinabusiness #techindustry #lifescienceindustry #medicaldevices #pharmaindustry

GOVERNMENT ANALYTICA ACADEMY: Learn more about 6-steps to Effective Government Advocacy with this quick 1-pager. Contact us to learn more about our capabilities and see how we can be of service to you.

[Last week and this week many governments are on their spring recess.]

HAPPENING THIS WEEK

MONDAY

Japan local elections all week.

TUESDAY

The International Monetary Fund and World Bank hold their Spring Meeting through April 16.

WEDNESDAY

European Automotive Decarbonization and Sustainability Summit 2023, 12-13 April Frankfurt, Germany

THURSDAY

Vote will be cast on the adequacy of the protection afforded by the EU-U.S. Data Privacy Framework – adoption of motion for a resolution.

FRIDAY

A slow day in politics.

SATURDAY & SUNDAY

G7 Ministers’ Meeting on Climate, Energy and Environment.

Starting Sunday G7 Foreign Ministers’ Meeting.

GLOBAL ECONOMIC PULSE

Th world is still looking out for signs of a recession, given the recent tightening of financial conditions. Inflation rates in the US, China and EU will be released this week. U.S. and Canadian central banks will share their reading of the economy and how they may set interest rates. UK and Singapore GDP, EU industrial production data, US retail sales, and China’s trade, and Australia’s unemployment level will be released.

Earnings Reports This Week: Albertsons Cos. (ACI), CarMax Inc. (KMX), Infosys Limited (INFY), First Republic Bank (FRC), Washington Federal Inc. (WAFD), Winmark Corporation (WINA), Progressive Corporation (PGR), Fastenal Company (FAST), and Delta Air Lines (DAL), UnitedHealth Group (UNH), JPMorgan Chase (JPM), Wells Fargo (WFC), BlackRock (BLK), Citigroup (C), and PNC Financial Services (PNC).

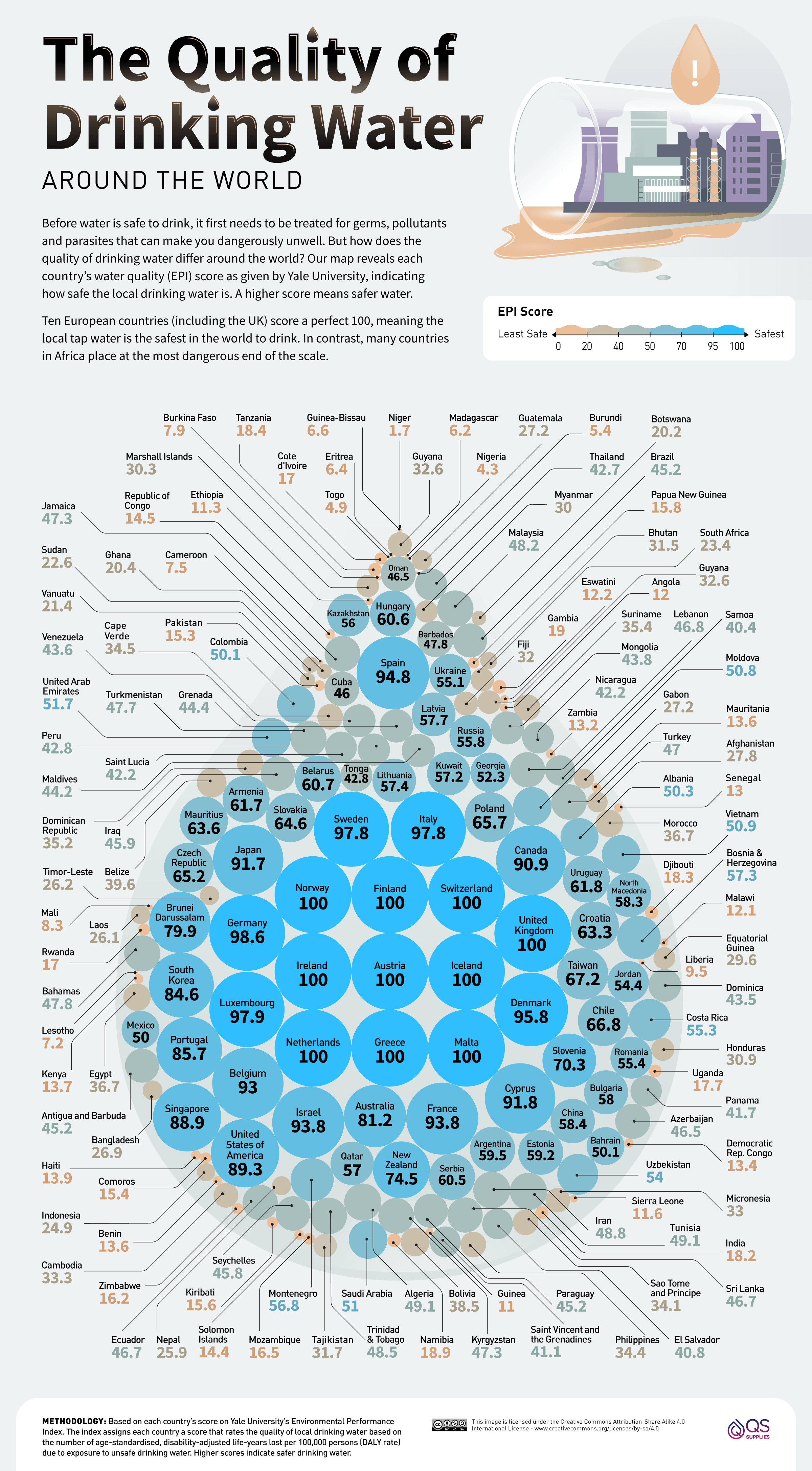

Our weekly infographic focuses on water quality from around the world. Source data is The Yale University 2022 Environmental Performance Index (EPI). It provides a data-driven summary of the state of sustainability around the world. Using 40 performance indicators across 11 issue categories, the EPI ranks 180 countries on their progress toward improving environmental health, protecting ecosystem vitality, and mitigating climate change. The EPI offers a scorecard that highlights leaders and laggards in environmental performance and provides practical guidance for countries that aspire to move toward a sustainable future

NOTEWORTHY REGULATIONS, LEGISLATION, DECISIONS & REPORTS

- U.S. Government published a draft Circular designed to assist analysts in the U.S. government regulatory agencies by providing guidance on conducting high-quality and evidence-based regulatory analysis and standardizing the way benefits and costs of Federal regulatory actions are measured and reported. The draft is open for public comment.

- Mexican Government published US-MEXICO TASK FORCE FOR THE ELECTRIFICATION OF TRANSPORT: Diagnosis and Recommendations for the Transition of Mexico’s Automotive Industry

- Ford published its Climate Change Report.

- UK published its UK R&D Funding Policy.

- WHO European Centre for Primary Health Care published its 2022 Annual Report

- United Nations published Financing for Sustainable Development Report 2023 by the Inter-agency Task Force on Financing for Development

- U.S. Department of Transportation published a list of its U.S. DOT Stakeholders.

- Ernst & Young published its annual Global Tax and Immigration Guide.

- World Bank published Europe and Central Asia Weak Growth, High Inflation, and a Cost-of-Living Crisis.

How can we help you? Click to learn …

Contact us to learn more about our capabilities and see how we can be of service to you.

AREAS WE TRACK

- MULTILATERAL INSTITUTIONS & DEVELOPMENT

- GEOPOLITICS & POLITICAL RISK

- SUPPLY CHAINS & INDUSTRIAL POLICY

- ECONOMY, FISCAL STIMULUS & SURPLUS SPENDING

- FINANCIAL SERVICES, LABOR & TAXES

- INFRASTRUCTURE & CONSTRUCTION

- ENERGY & ENVIRONMENT

- HEALTHCARE

- TECHNOLOGY

- AEROSPACE & AVIATION

- AUTO & ELECTRIC VEHICLE INDUSTRY

READERSHIP PROFILE

Get a head start on upcoming global political and economic events this week that will shape your business, strategy, and portfolio in just 5 minutes. Our subscribers are: C-Suite executives, leaders in associations, nonprofits, NGOs, major consulting companies, think tanks, ministers and members of parliaments. They hail from the U.S. and dozens of other countries, mostly developed and fast-growing emerging economies. On average, over 70% open and read our newsletter. Start your week with a generous dose of foresight.