Be the first to know! Get a head start on global political and economic events this week that will shape your business, strategy, and portfolio in just 5 minutes. Start your week with a generous dose of foresight. Be the first to lead! Subscribe to our newsletter to receive the latest edition, every Monday.

#governmentanalytica #electricvehicles #batteries #pandemics #artificialintelligence #safety #singleuseplastic #globalhealth #asean #apec #eu #latinamerica #chinabusiness #techindustry #lifescienceindustry #medicaldevices #pharmaindustry

GOVERNMENT ANALYTICA ACADEMY: Learn more about 6-steps to Effective Government Advocacy with this quick 1-pager. Contact us to learn more about our capabilities and see how we can be of service to you.

HAPPENING THIS WEEK

MONDAY

In Madrid, from 20-23 February, the REN21 and the Spanish national government will host the Spanish International Conference on Renewable Energy (SPIREC). With many major global infrastructure companies headquartered in Spain, conference aims to focus on how to build a more secure, resilient, and sustainable energy system. In Addis Ababa, the Africa Business Forum 2023 will take place today, on the margins of the thirty-sixth ordinary session of the Assembly of Heads of State and Government of the African Union. The Forum will be jointly convened by the United Nations Economic Commission for Africa (ECA) and the African Export-Import Bank, with the support of the African Union Commission; Sustainable Energy for All will be a resource partner.

TUESDAY

Aerospace, Defense & Government Contracting Compliance & Ethics Conference, by Society of Corporate Compliance and Ethics (SCCE) online. Asia Pacific National Government Business Development Meeting, 21-23 Feb, Hanoi, Vietnam

WEDNESDAY

Slow day in politics

THURSDAY

In Montreux, the Fifth Global Ministerial Summit on Patient Safety, hosted and organized by the Swiss Government, with support from the World Health Organization (WHO), will be held from 23 to 24 February. The slogan this year “Less harm better care – from resolution to implementation” reflects the need for sustainable implementation of the Resolution WHA72.6 on ‘Global Action on Patient Safety’ and the ‘Global Patient Safety Action Plan 2021–2030: Towards eliminating avoidable harm in health care‘.

FRIDAY

International Conference on Intelligent Transportation and Smart Cities (ICITSC 2023), 24-25 February 2023, Kaifeng, China. Westminster Legal Policy Forum, London UK.

SATURDAY & SUNDAY

Nigerian elections are on Saturday.

GLOBAL ECONOMIC PULSE

Delloite suggests the global economy continues to surprise investors and pundits by its relative strength. GDP growth numbers for the fourth quarter of 2022 were better than expected in the United States and Eurozone, inflation appears to be decelerating in both North America and Europe, job markets remain unusually tight, and China’s reopening has excited businesses with the prospect of renewed Chinese demand. Strong U.S. economic data last week has everyone looking at the central bank response. U.S. 4th quarter GDP and inflation data will be released on Friday. German Business Climate Index (IFO) and Economic Sentiment Index (ZEW) surveys are due. Mild European winter and lower natural gas prices are drivers. New Zealand must balance a potential rate hike with Cyclone Gabrielle’s economic impact.

The 1 and 5-year Loan Prime Rate in Brazil will be disclosed. One-year Medium-Term Lending Facility rate was unchanged last week. Key interest rate decisions in emerging markets are due from Turkey (currently at 9.0). Brazil’s Consumer Price Index will be reported. Argentina fourth quarter GDP data is due. Expectations are the economy is in contraction. Peru will release GDP. Central bank meeting will take place in South Korea.

Earnings Reports This Week: Fuji Heavy Industries, Walmart, Home Depot, HSBC, Medtronic, Alcon, NVIDIA, Rio Tinto, Iberdrola, Baidu, Danone, Henkel, Alibaba, Intuit, Deutsche Telecom, Moderna, Bouygues, Mercado Libre, Anglo American, Lloyds, Warner Bros., Birkshire Hathaway, China Construction Bank, BASF.

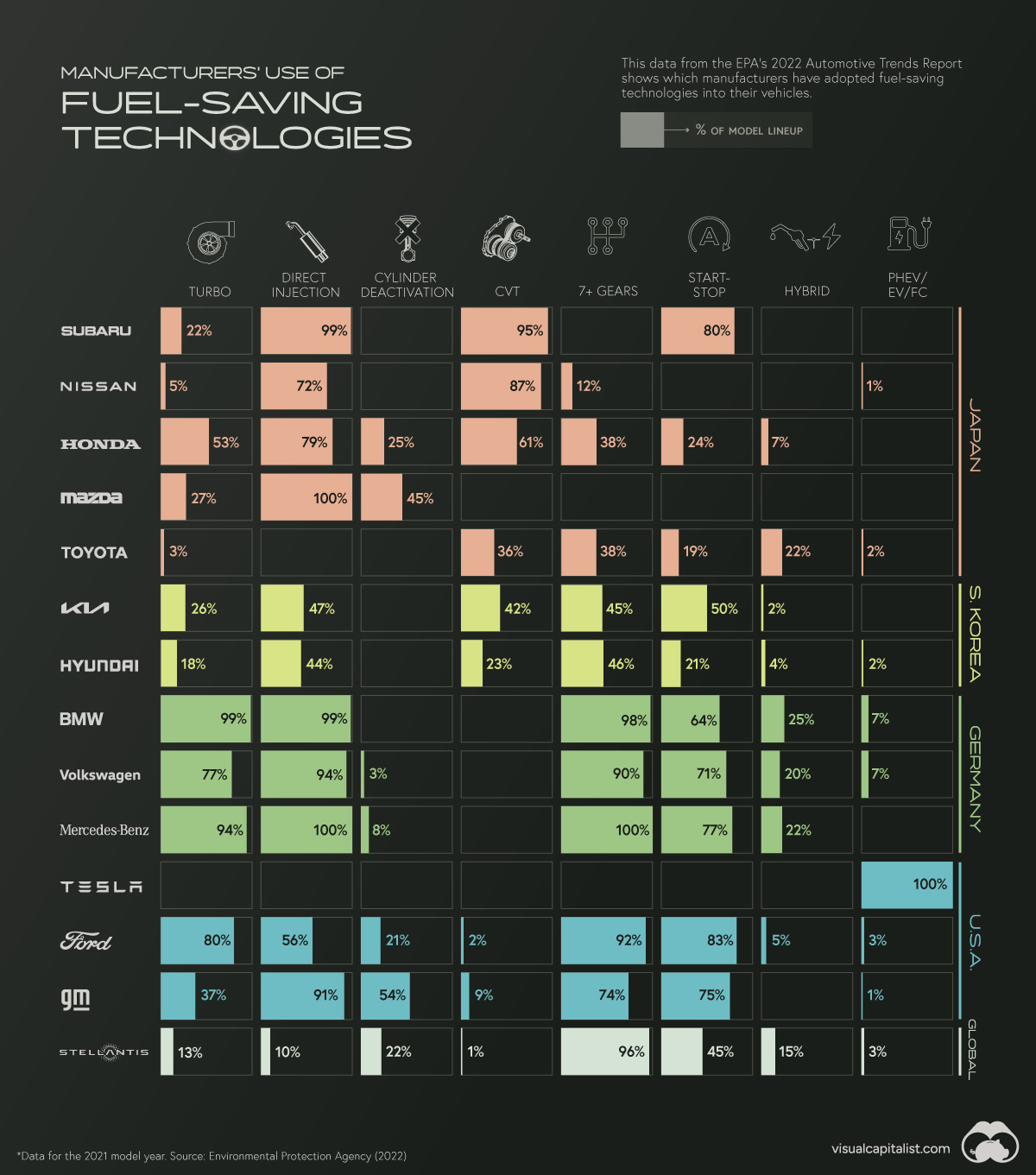

Auto companies are hard at work to transform their portfolios to electric vehicles as costs come down and technology and supply chain gaps are bridged. Chart below from Visual Capitalist traces their journey. Click the image to see details.

NOTEWORTHY REGULATIONS, LEGISLATION, DECISIONS & REPORTS

Canada published it annual status report on its health care system, “CANADA HEALTH ACT ANNUAL REPORT”. Companies and associations can learn about the opportunities to help bridge gaps and amplify the strengths of the Canadian system.

The Friedrich-Ebert-Stiftung published a report “Building partnerships for an international hydrogen economy: Entry-points for European policy action”. Increasingly hydrogen-based energy approaches are gaining interest in developed and developing economies. There may be opportunities for companies to provide solutions to remove technological obstacles.

Wales published its “National Transport Delivery Plan 2023-2027”. Companies and associations in the transport sector may be interested.

South Africa published its new Small Business Support Strategy. Organizations looking for small business partners in South Africa may want to explore this option.

U.S. President’s Emergency Plan for AIDS Relief’s (PEPFAR’s) new country strategy was published last week. Associations, nonprofits and NGO’s as well as pharma companies may be interested in this strategy and its implications for their portfolio.

U.S. think tank, Brookings Institution, published KEYS TO CLIMATE ACTION CHAPTER ONE | OVERVIEW: HOW DEVELOPING COUNTRIES COULD DRIVE GLOBAL SUCCESS AND LOCAL PROSPERITY

U.S. Congressional Research Service has published a report on Capital Markets Policy Issues for the 118th U.S. Congress. Financial and investment companies as well as corporations may find it interesting. It makes explicit references to ESG themes.

Business Environment Working Group has published a Technical Report titled “Roles of the Business Environment in Global Value Chains”

U.S. Department of Energy identified and brought together the leading experts in lithium battery technology from across the U.S. industry in a project called Li‑Bridge. The purpose of Li‑Bridge is to develop a strategy for establishing a robust and sustainable supply chain for lithium battery technology in North America. This groups first report is out titled: “Building a Robust and Resilient U.S. Lithium Battery Supply Chain”. Auto manufacturers, lithium battery producers, and those part of the supply chain and associations representing them may be interested in the outcomes cited in this report.

The Government of India’s passage of the $10.2 Billion Semicon India Program (Program for Development of Semiconductors and Display Manufacturing Ecosystem in India) for the development of a sustainable semiconductor ecosystem in India. The Semiconductor Industry Association (SIA) together with the in-country partner, APCO Worldwide has put together this white paper for the Government of India titles: “INDIA SEMICONDUCTOR SECTOR: Increasing India’s Role within the Global Semiconductor Value Chain”. The paper details macro principal recommendations for India’s approach to the semiconductor ecosystem and offerings as well as highlights specific issues that have been raised as concerns that affect India’s favorability as an investment and/or expansion destination. This may influence and impact companies building collaborative relationships with India’s semiconductor sector.

RenewableUK has published a set of recommendations in a report titled: “Retaining the UK’s leadership in renewables Recalibrating policy in the midst of an energy crisis and increasing global competition”.

Indian Government has published India Outcome Budget. It presents (a) the financial outlay for the year 2023-24 along with (b) clearly defined outputs and outcomes (c) measurable output and outcome indicators and (d) specific output and outcome targets for FY 2023-24. This will significantly enhance transparency, predictability and ease of understanding of the Government’s development agenda. Companies and associations may find information on areas of emphasis and de-emphasis in this biannual document.

Gibson Dunn has published an excellent synopsis of public domain information on current regulatory and legislative activities titled: “2023 Environment Update”. Companies and association may find important information about regulatory and legislative changes underway having to do with the environment.

Business Enabling Environment (BEE) is a new benchmarking exercise under development in the World Bank’s Development Economics Global Indicators Group. BEE will provide a quantitative assessment of the business environment for private sector development, published annually and covering most economies worldwide. BEE data and the summary report will aim to advocate for policy reform, inform specific policy advice, and provide data for development policy research.

U.S. Congressional research service has published a report on Sea Mining. For rare earth metals this is a hot area of exploration.

The U.S. Government is the largest donor to global health in the world and includes support for both disease (HIV, tuberculosis, malaria, and neglected tropical diseases) and population (maternal and child health, nutrition, and family planning and reproductive health) specific activities as well as global health security. Most U.S. funding for global health is provided bilaterally (approximately 80%). Of the multilateral share, the majority is provided to The Global Fund to Fight AIDS, Tuberculosis and Malaria (Global Fund). A report has been published titled: “Breaking Down the U.S. Global Health Budget by Program Area”

How can we help you? Click to learn …

Contact us to learn more about our capabilities and see how we can be of service to you.

Slug: geopolitical-week-ahead